HIDCL Q4 2079/80 Financial Performance

A brief overview of HIDCL strong Q4 2079/80 financial performance, featuring notable growth in paid-up capital, strategic investments, and remarkable revenue surge

In line with the Government of Nepal's directive, Hydroelectricity Investment and Development Company Ltd. (HIDCL) was officially founded on July 11, 2011. Committed to sourcing financial resources from both domestic and international channels, HIDCL is dedicated to supporting investments in medium to large-scale hydroelectricity ventures.

Introduction

Recognizing the pressing need to rectify the national power deficit and seize the immense potential within the hydropower sector, a critical reevaluation of existing policies and initiatives was imperative. This pivotal shift occurred on July 6th, 2011.

Acknowledging three crucial factors:

- The prevailing status quo was detrimental to the nation

- An urgent resolution to the energy crisis was imperative

- The government needed a dedicated entity with substantial financial resources, specialized expertise, and a focused mission to effectively execute hydropower development projects.

The Government of Nepal made the monumental decision on July 6, 2011, to establish a Special Purpose Vehicle (SPV) known as Jalvidhyut Lagani Tatha Bikas Company Limited, or Hydroelectricity Investment and Development Company Limited (HIDCL) in English.

Objective

- HIDCL aims to raise funds for hydroelectric projects to combat the power shortage.

- Objectives include investing in hydro projects, partnering with financial institutions, and obtaining foreign funding.

- The company exclusively focuses on middle to mega-sized hydropower generation projects.

- HIDCL operates professionally, despite significant government equity funding.

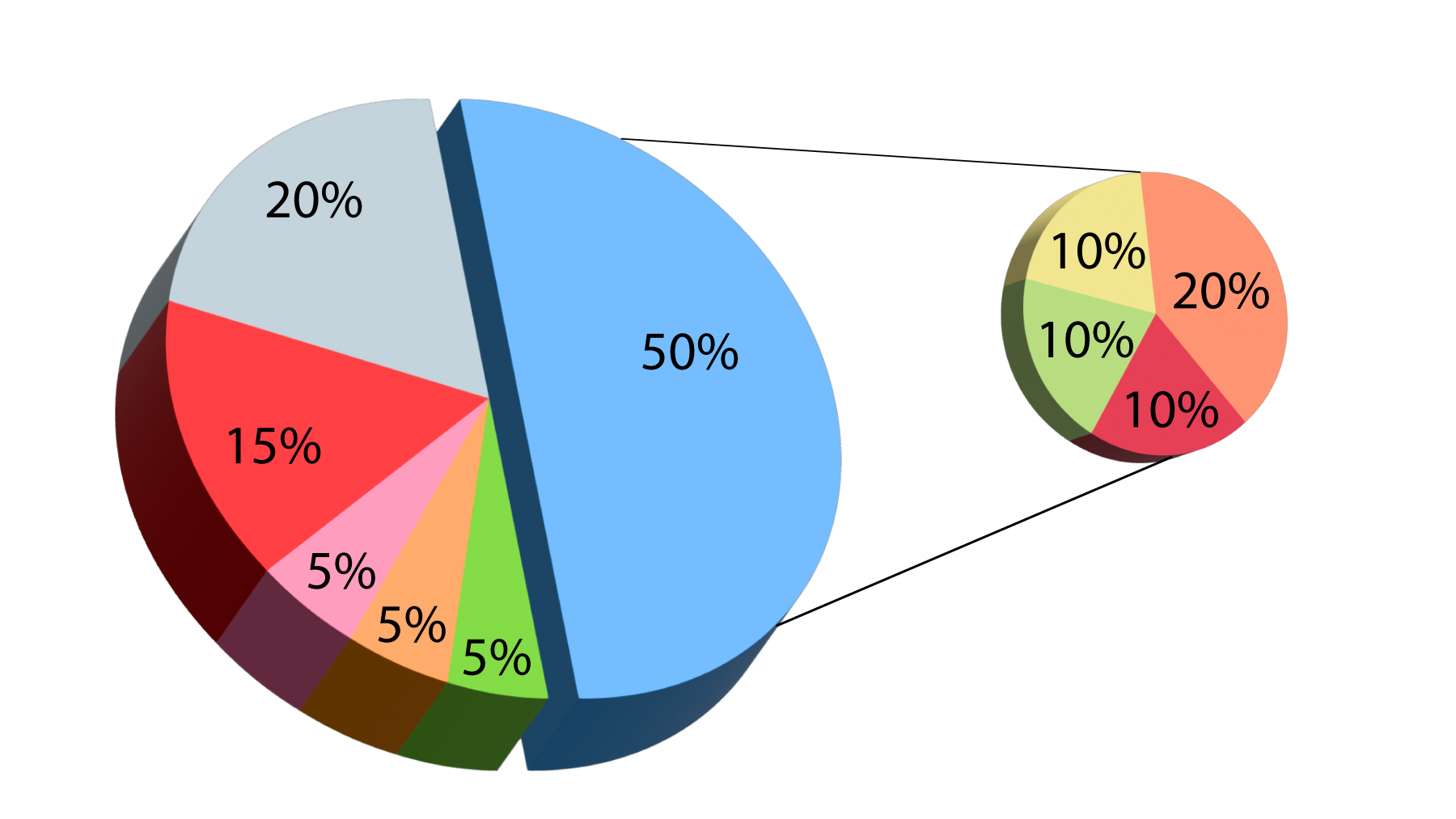

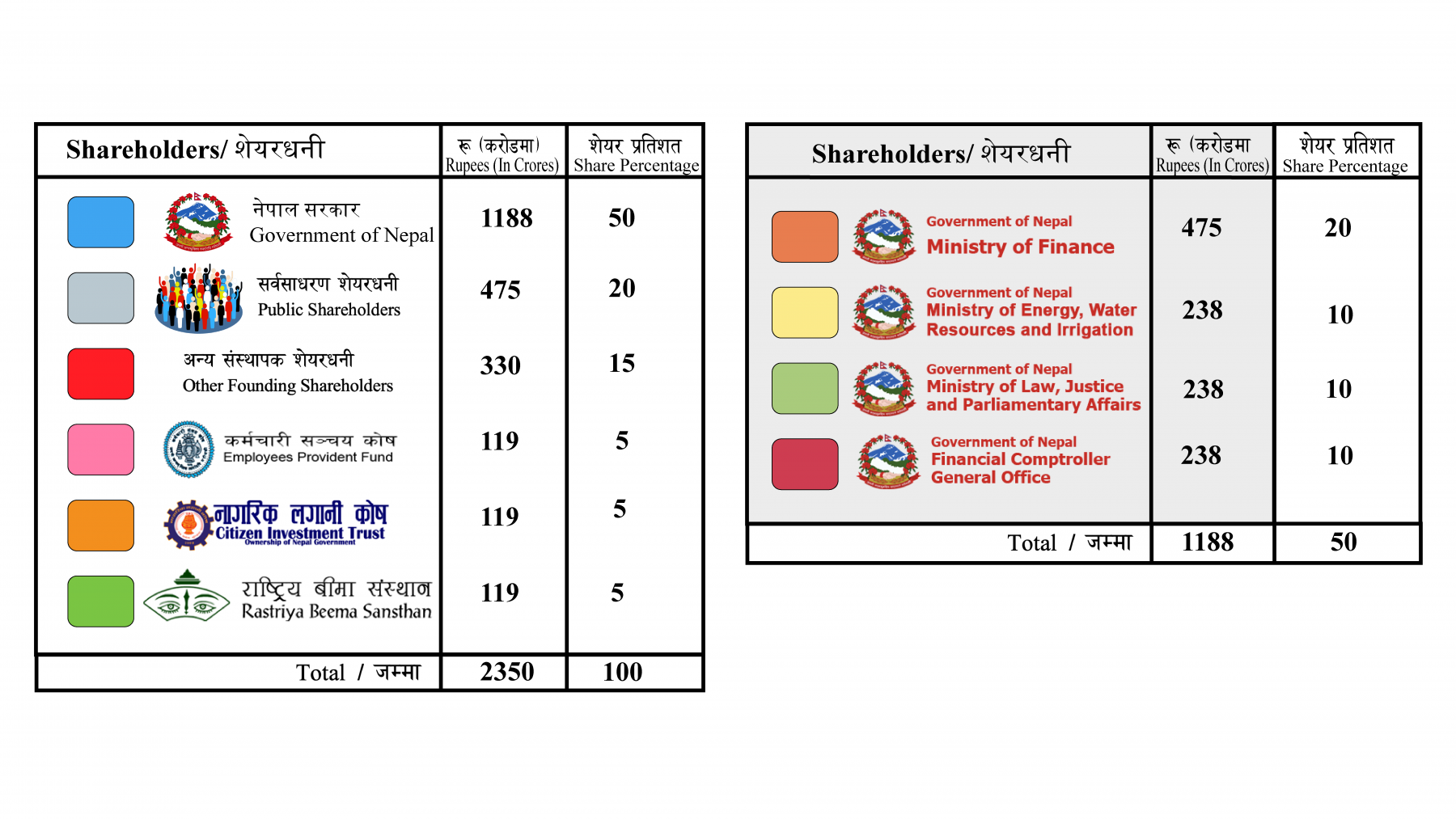

Capital Structure

The company's authorized capital stands at Rs. 50 billion, while the issued capital amounts to Rs. 23.50 billion. This capital distribution is structured as follows:

Image Source: HIDCL

Investments

Loan Commitment

Amount in NPR (million)

| Projects | Borrower | Capacity (MW) | HIDCL Commitment | Remaining to Disburse |

|---|---|---|---|---|

| Mistri Khola Hydro Electriciy | Mountain Energy Nepal Limited | 42 | 1,087.00 | - |

| Dordi Khola Hydro Electric Project | Himlayan Power Partner Limited | 27 | 589.00 | - |

| Solu Hydroelectric Project (Solukhumbu) | Upper Solu Hydroelectric Co. Limited | 23.5 | 200.00 | - |

| Lower Solu Hydroelectric Project (Solukhumbu) | Solu Hydropower Private Limited | 82 | 600.00 | 489.65 |

| Nyadi Hydropower Project (Lamjung) | Nyadi Hydropower Limited | 30 | 542.00 | 107.48 |

| Upper Solu Hydropower Project (Solukhumbu) | Beni Hydropower Project Limited | 18 | 200.00 | 19.01 |

| Solu Khola Dudh Koshi Hydropower Project | Sahas Urja Limited | 86 | 1,449.20 | 618.30 |

| Upper Trishuli 3B Hydroelectric Project | Trishuli Jalvidyut Co. Limited | 37 | 1,878.00 | 931.96 |

| Lower Likhu Hydroelectric Project (Ramechhap) | Swet Ganga Hydropower And Construction Limited | 28.1 | 911.80 | 82.03 |

| Bagmati Small Power Project (Lalitpur & Makwanpur) | Mandu Hydropower Ltd. | 22 | 200.00 | - |

| Upper Tamakoshi Hydroelectric Project | Upper Tamakoshi Hydropower Ltd | 456 | 2,000.00 | 900.00 |

| Total | 851.6 | 9,657.00 | 3,148.43 |

Equity Commitment

Amount in NPR (million)

| Company/Projects | Equity Commitment (in %) | Equity Commitment (in Rupees) | Total Equity Investment | Remaining to Disburse |

|---|---|---|---|---|

| Power Transmission Company Limited | 14% | 63 | 63 | - |

| Remit Hydro Limited | 51% | 2,130 | 535 | 1,595 |

| Simbuwa Remit Hydro Limited | 51% | 1,940 | 351 | 1,589 |

| Vidhyut Utpadan Company Limited | 4% | 800 | 269 | 531 |

| NEA Engineering Company Ltd | 15% | 30 | 23 | 8 |

| Nepal Power Trading Company Limited | 15% | 30 | 2 | 28 |

| Phukot Karnali Hydroelectricity Project | 10% | 1,260 | - | 1,260 |

| Vision Energy And Power Private Limited | 19% | 500 | 500 | - |

| Vision Lumbini Urja Company Ltd | 13% | 200 | 200 | - |

| Madi Storage Hydroelectricity Project | 26% | 3,040 | 39 | 3,001 |

| Tamor Storage Hydroelectricity Project | 51% | 28,920 | 3 | 28,917 |

| Jagadulla Hydropower Company Limited | 10% | 700 | 234 | 466 |

| Mewa Developers Ltd | 20% | 460 | 460 | - |

| Total | 40,073 | 2,679 | 37,394 |

Financial Statement

| Particulars (In Rs '000) | Q4 2079/80 | Q4 2078/79 | Difference |

|---|---|---|---|

| Paid Up Capital | 22,775,799.38 | 20,715,052.00 | 9.95% |

| Reserve Funds | 1,912,649.53 | 1,652,752.29 | 15.75% |

| Loan to Power Projects | 9,180,665.04 | 6,388,236,80 | 43.75% |

| Net Profit | 1,384,249.95 | 957,829.11 | 44.50% |

| EPS (In Rs.) | 6.08 | 4.62 | 31.61% |

| Net Worth per Share (In Rs.) | 108.40 | 107.98 | 0.39% |

| Qtr end PE Ratio (times) | 30.27 | 43.25 | 42.87% |

| Qtr End Market Price | 173.95 | 213 | 22.48% |

Market Analysis

Stock Performance:

- Current LTP (Last Traded Price): NPR 162.2

- 52-Week High-Low Range: NPR 240.00 - NPR 159.80

- This indicates a stock that has experienced fluctuations within the past year, potentially presenting an opportunity for investors.

Historical Averages:

- 180 Days Average: NPR 187.43

- 120 Days Average: NPR 180.76

- These figures provide insights into the stock's performance trend, helping investors make informed decisions.

Dividends:

- Bonus Share: 5%

- Cash Dividend: 0.263%

In conclusion, the financial performance of Hydroelectricity Investment and Development Company Limited (HIDCL) for the third quarter of 2079/80 demonstrates notable progress and stability across various key metrics.

- Paid-up capital rose by 9.95%.

- Reserves increased by 15.75%.

- Investment in power projects surged by 43.75%.

- Net profit soared by 44.50%.

- EPS saw a 31.61% increase.

- Net worth per share increased by 0.39%.

- Market confidence shown with PE ratio of 30.27.

Overall, HIDCL demonstrated robust growth and financial strength in Q4.